This blog-entry contains the second part of my serialization, within this blog, of the Equitist Advocacy Group's groundbreaking manifesto entitled "Malady and Remedy: What's Wrong, and What to Do About It", with my own edits added to their text, for its improvement [at least, I think so!].

In my opinion, this text is too important to be treated as any kind of "sacred text".

It needs to be improved upon, and circulated <<samizdat>>, worldwide, in such "improved" forms -- i.e., in as many versions as are seen as being needed, by every author who thinks that [s]he can improve upon it [including this one].

Here is a link to the original version, including to its "endnotes" --

http://equitism.org/Equitism/Equitism-entry.htm

http://www.equitism.org/Equitism/MaladyAndRemedy/MaladyAndRemedy.htm

Regards,

Miguel

Part 2.: Malady and Remedy --

What's Wrong, and What to Do About It.

Diagnosis: What's Wrong

[continued].The Genesis of the Core Plutocracy's 'Capitalist Anti-Capitalism'

The competition among capitals, the incentive of

[transient] super-profitability to those capitalists who effectively innovate

to achieve reductions in the unit-cost of producing their commodity-output,

relative to the level of unit cost being incurred by their competitors — plus,

the struggle of the owners of capital to subjugate "their" labor

force — stimulate technological advances in the methodologies and

instrumentalities of capital-based commodity production.

The effect of these advances is to raise ‘‘‘productivity’’’.

‘‘‘Productivity’’’ is raised, for example:

The effect of these advances is to raise ‘‘‘productivity’’’.

‘‘‘Productivity’’’ is raised, for example:

- by producing more units of commodity-output in less duration of time; and/or

- with the productive-consumption-of less/less-costly units of direct-labor; and/or

- with the productive-consumption-of less/less-costly units of other inputs;

and thus, for any one, or for any combination of the above,

by producing the commodity output in question at a lower cost per

unit-of-that-commodity-output.

This creates opportunities which include, e.g., the option

to sell that output:

- with the same price as, but at a higher profit-margin than, those that the less technically advanced competition is charging, and achieving; or

- to undersell that competition via a lower price at the same profit-margin which that competition was garnering. [e1_3]

The actualization of such opportunities results in that

competition dying off; in that competition being absorbed into and/or

being dissolved by the higher-productivity competitor, or in that competition

adopting the same or a better technological advance.

This latter option assumes that those competitor-firms can

so adopt, without going bankrupt, due to the incremental costs, incurred by

them, for this adoption.

These technological advances become increasingly threatening to the wealth-binding and power-binding capital-value-content of the hyper-concentrated capital-holdings of the emerging capitalist plutocracy, as the balance of their capital-investment expenditures shifts relatively, but increasingly, toward "plant and equipment" expenditures, over-and-above wages-and-salaries expenditures, or living human-labor power expenditures.

These capital, plant, and equipment holdings of that plutocracy accumulate partly in the forms of directly-owned "plant and equipment" capital-assets, for the direct ‘industrial-capital-ists’, but also partly in the form of "capital equity stock" capital-assets, "corporate bond" capital-assets, "long term bank loan" capital-assets, etc., which simply represent plutocracy's members’ indirect ownerships of such "plant and equipment" capital-assets, especially for the ‘finance-capital-ists’ and ‘banking-capital-ists’ among this emerging plutocracy.

This threat grows, as the proportion of wealth held by the plutocracy in these forms grows, and as the rate of technological advance accelerates in response to the transient super-profits-incentives stimuli cited above, with advancing accumulation of capital-asset value.

As these technology-forms, incented by the capitals-system, advance, an ever-greater relative proportion of the physical mass of the physical assets used in plutocracy-owned industrial production takes these "plant and equipment" ‘socio-mass’ forms, vis-á-vis, the forms of the living human "socio-bio-mass" of the human work force.

Likewise, the monetary-value-‘‘‘mass’’’ of such "plant and equipment" — and the monetary-value-‘‘‘mass’’’ of its per-unit-of-output charges for "wear and tear", or "physical", depreciation-expense, included in the prices of the plutocracy's sold output — increasingly exceeds the monetary-value-‘‘‘mass’’’ of the wage-and-salary expenses also covered by those intended prices.

These technological advances become increasingly threatening to the wealth-binding and power-binding capital-value-content of the hyper-concentrated capital-holdings of the emerging capitalist plutocracy, as the balance of their capital-investment expenditures shifts relatively, but increasingly, toward "plant and equipment" expenditures, over-and-above wages-and-salaries expenditures, or living human-labor power expenditures.

These capital, plant, and equipment holdings of that plutocracy accumulate partly in the forms of directly-owned "plant and equipment" capital-assets, for the direct ‘industrial-capital-ists’, but also partly in the form of "capital equity stock" capital-assets, "corporate bond" capital-assets, "long term bank loan" capital-assets, etc., which simply represent plutocracy's members’ indirect ownerships of such "plant and equipment" capital-assets, especially for the ‘finance-capital-ists’ and ‘banking-capital-ists’ among this emerging plutocracy.

This threat grows, as the proportion of wealth held by the plutocracy in these forms grows, and as the rate of technological advance accelerates in response to the transient super-profits-incentives stimuli cited above, with advancing accumulation of capital-asset value.

As these technology-forms, incented by the capitals-system, advance, an ever-greater relative proportion of the physical mass of the physical assets used in plutocracy-owned industrial production takes these "plant and equipment" ‘socio-mass’ forms, vis-á-vis, the forms of the living human "socio-bio-mass" of the human work force.

Likewise, the monetary-value-‘‘‘mass’’’ of such "plant and equipment" — and the monetary-value-‘‘‘mass’’’ of its per-unit-of-output charges for "wear and tear", or "physical", depreciation-expense, included in the prices of the plutocracy's sold output — increasingly exceeds the monetary-value-‘‘‘mass’’’ of the wage-and-salary expenses also covered by those intended prices.

This threat to the plutocracy's ‘money-power’, or

‘money-capital-power, grows because technological advances — concretized by

competitors — increasingly tend to evaporate and vanish the capital-value of the plutocracy's "plant

and equipment" holdings, due to technological,

obsolescence depreciation, or due to the non-physical-local, non-wear-and-tear”,

kind of depreciation, which Marx termed “moral depreciation”.

Thus, the vulnerability of plutocracy-owned capital-assets to technological, obsolescence depreciation accelerates as that plutocracy's "plant and equipment" capital-value, and as capital's technology, both accumulate together, in increasing relative preponderance to the also-increasing value of wages-and-salaries expenses.

Later, lower purchase-cost vintages, and/or technologically-superior vintages, of capital-value — newly-incarnated in such advantaged "plant and equipment" capital — massacre the capital-value of earlier, higher-cost, and/or technologically-inferior vintages.

Thus, the vulnerability of plutocracy-owned capital-assets to technological, obsolescence depreciation accelerates as that plutocracy's "plant and equipment" capital-value, and as capital's technology, both accumulate together, in increasing relative preponderance to the also-increasing value of wages-and-salaries expenses.

Later, lower purchase-cost vintages, and/or technologically-superior vintages, of capital-value — newly-incarnated in such advantaged "plant and equipment" capital — massacre the capital-value of earlier, higher-cost, and/or technologically-inferior vintages.

As the rate of technological innovation accelerates, these

later vintages perform this massacre long before those earlier capital-value

vintages — now relatively disadvantaged — can be

"amortized", via "normal", physical "wear and

tear" depreciation-charges recouped from sales of their output.

That is, eventually, as capital-value accumulation progresses, the average period between technological advances in machinery-design becomes shorter than the average period of physical wear-and-tear depreciation of that machinery, as a result of the ‘profits-incented’ accelerating rate of technological change.

That is, eventually, as capital-value accumulation progresses, the average period between technological advances in machinery-design becomes shorter than the average period of physical wear-and-tear depreciation of that machinery, as a result of the ‘profits-incented’ accelerating rate of technological change.

Thereafter, competing new vintages perform this

monetary-value massacre on the obsolete vintages long before the capital-value

of the obsolete vintages can be recovered, together with an adequate, positive

"return on" their investment.

That recovery of value would have been achieved only if the output of these

capital-value production-assets were successfully sold at prices which covered

this physically "used up" capital-value.

Once the average '''technological life''' of such

"plant and equipment" capital becomes shorter than the average

'''physical life''' of that "plant and equipment" capital, this recovery

fails, and "return on" investment becomes "loss on"

investment.

Concomitantly, the preponderance of industrial operating-capital invested shifts, from taking the form of wages-and-salaries, to taking the form of capital "plant and equipment".

This shift in the preponderance of the monetary-value of capital investment from the wages-and-salaries side to the "plant and equipment" side, is itself a reflection of the technological gains in productivity -- the “growth in the social forces of production” [Marx] -- that have been achieved.

Consider what happens, once this preponderance shift has occurred at the level of a given industry as-a-whole.

Concomitantly, the preponderance of industrial operating-capital invested shifts, from taking the form of wages-and-salaries, to taking the form of capital "plant and equipment".

This shift in the preponderance of the monetary-value of capital investment from the wages-and-salaries side to the "plant and equipment" side, is itself a reflection of the technological gains in productivity -- the “growth in the social forces of production” [Marx] -- that have been achieved.

Consider what happens, once this preponderance shift has occurred at the level of a given industry as-a-whole.

Competitive installation of new capital "plant and

equipment", that is yet more productive still, tends to induce a

monetary-value loss to competing capitals, due to technological, obsolescence depreciation.

It also tends to induce monetary-value gains

to the capitals installing the innovation, due to the per-unit-of-output

savings of wages-and-salaries, and/or due to the per-unit-of-output savings of

raw-and-auxiliary-materials' costs, and/or of other production costs, that may

result from and as this increased productivity.

However, once this preponderance shift has occurred, those

technological, obsolescence

depreciation losses tend to exceed those gains due to

savings, for the competing capitals forced to adopt these innovations by

competition from the early adopter(s).

Thus, the net effect, at the industry level, of these countervailing gains-and-losses, both triggered by the same act of competitive installation of technologically-superior "plant and equipment", by competitors, is negative — is a negative profit overall [i.e., a net loss], and/or a negative increment to '''capital-value accumulation'''/"retained earnings" [i.e., a net reduction to accumulated capital-value].

Thus, the net effect, at the industry level, of these countervailing gains-and-losses, both triggered by the same act of competitive installation of technologically-superior "plant and equipment", by competitors, is negative — is a negative profit overall [i.e., a net loss], and/or a negative increment to '''capital-value accumulation'''/"retained earnings" [i.e., a net reduction to accumulated capital-value].

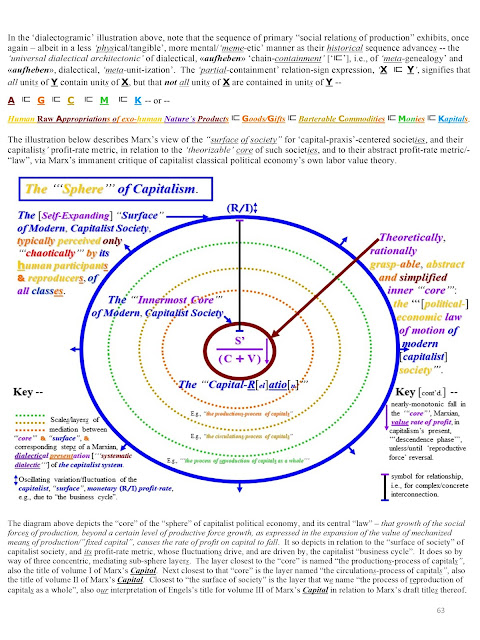

From being a process primarily of “self-expanding

[capital-]value”, the industrial capitals-process has shifted to

increasingly become a process of “self-contracting

[capital-]value”.

The latter process was reflected, in U.S. economic

history, in prolonged, post-Civil-War “Great Deflation”, which continued from ~1866

through ~1900, and which induced the U. S. section of the plutocracy to resort

to desperate measures to impose the Federal Income Tax, and the “Federal”

Reserve, in 1913, and which led the global plutocracy to desperate imposition

of World War I starting in 1914.

To give a more recent, impending example of the ‘techno-depreciation effect’ on the plutocracy -- one which is driving the plutocracy to desperate deeds to this very day:

The invention and implementation of an “aneutronic”,

“direct conversion”, zero-pollution variety of fusion-power reactors, say fusion-power

reactors fueled by water and Boron [proton/Boron 11 reaction], and radiating

only charged particles -- also supplying the low-cost power needed to

desalinate, and mine for minerals, the ocean solution, at fusion

fueling/desalination plants on the desert coast-lines of the world, e.g.,

‘low-costedly’ irrigating and ‘re-agriculturalizing’ the Sahara, and also

supplying the “fusion torch”, ‘plasma torch’ technology needed to

‘low-costedly’ recycle industrial waste-products completely,

reducing them back to their atomic-elemental constituents, and potentially also

supplying, using neutron-emitting fuel cycles, the neutron fluxes necessary to

‘de-radioactivate’ legacy, fission-power radioactive wastes -- would

more-or-less rapidly technologically-depreciate, to near-zero, the entire petroleum

"plant and equipment" capital-assets owned by the global

petroleum/finance plutocracy, were that plutocracy ever to permit such a

technological advance to "see the light of day".

Hypothesis:

Consequently, all of those scientists who successfully advocate and/or

achieve reactor designs creating sustained fusion reactions -- recall Philo

Farnsworth, Dr. Stanley Pons, Dr. Martin Fleischmann, Dr. Eugene Mallove, Dr.

Robert Bussard, Andrea Rossi, Sergio Focardi -- come to a rapid demise, in one

way or another, shortly after their success becomes widely publicly known.

Note to Readers:

Typographical and notational conventions observed throughout this text

are described in the 'zeroth' endnote. [e0]

SOLUTION –

‘Equitist Political-ECONOMIC

DEMOCRACY’;

BOOK:

MARX'S MISSING BLUEPRINTS

Free of Charge Download

of Book PDF --

http://www.dialectics.info/dialectics/Applications.html

Hardcover Book Order --

http://www.dialectics.info/dialectics/F.E.D._Press.html

https://www.etsy.com/shop/DialecticsMATH

No comments:

Post a Comment